Experian Aggregated Reviews

Experian 01

This is similar to bank bazaar who have tied up with experian. Experian credit score is usually higher by 3 to 9% compared to CIBIL. I’ve checked both for my entire family. Indian banks usually use CIBIL so this may not be of great use.

source

Experian 02

I use the experian app and had a notification immediately after I applied.

source

Experian 03

I checked my spam folder and found an email from Experian with some links to more top level domains that I don’t recognize. Clearly they haven’t learned anything from the breach about protecting customer data. Every step of the way I have had to put more personal data into random websites to access the identity protection service they offer.

source

Experian 04

The main pitfall to services like this is that the score will be different than your ACTUAL FICO at Experian, TransUnion, and Equifax , which will be different from each other. It’s more good for a general idea of “my credit is in solid shape” or “my credit is fugly and I need to work on it” than an exact measure.

source

Experian 05

No, they can’t check fraud alerts either. I had one put on my credit and even though other companies were able to check my credit with no issue for some reason Project Fi’s credit check couldn’t. After two calls, two chats, and an email inquiry, nobody at Fi I could give me any answers except to contact Experian directly. And then, when I called the number they gave me, there was no option whatsoever to talk to a live human being. I ended up giving up.

source

Experian 06

For a long time I had student loans I couldn’t handle, so I just lived without credit. Those delinquencies are now past the 7 year mark (and I’ve rehabilitated the loans), so I can start building credit again. I have two credit cards, no missed payments, and zero utilization. I have no debt other than my student loans (which don’t show on credit reports anymore because they’re old). My VantageScore is over 700 with Equifax and TransUnion. Great, right?

Nope. I have a solitary collections mark, which I paid in full, but it still shows on my Experian FICO. It’s incorrectly dated to a few months ago, as well, which I think makes the impact worse. Bottom line: My Experian FICO is 620, which means I get turned down for everything.

This one mark is costing me like 65 points on my score. It’s a huge liability for a debt that I paid in full as soon as I found out about it. I called the company who reported the debt, with no help. I called Experian and asked to dispute the mark, but if that gets no results, is there any point to trying a firm like Lexington Law? I see stories of people saying they got countless marks removed, but considering I only have one bad one, do you think it’s worth a shot?

source

Experian 07

You can get experian’s report for free also by signing up on the experian website.

source

Experian 08

The last thing I would be doing is giving my information to even more databases and monitoring services. I’d opt out of as much of this as possible personally. I want fewer people having access to my info, fewer logins, fewer passwords, fewer servcies to keep track of. Credit Karma gives me access to my Equifax and Transunion reports and I can get my Experian once a year from annuallcreditreport. I think Amex may give me my Experian report as well. That’s plenty for me.

source

Experian 09

I pulled my credit reports and it turns out there was a negative item that had just been added. A cleaning bill from my last apartment. I had moved out about 8 months ago. I never received the bill and it got sent to collections. I’m in the process of clearing that up now. As far as the letter goes, I’m still not sure that it was legit. I figured it could be a scam done by anyone who knew about the collection. It very well could have been real, but I still thought it was too risky to send my ssn and other personal info through the mail or give it over the phone to the number provided in the letter . So I went to annualcreditreport.com to get my reports (you can get one of each free once per year) then I filed a dispute with each credit bureau through their websites. Experian deleted it and I’m still waiting on dispute results from the other two. I’d say it’s safer to deal directly with known reputable websites and the credit bureaus. Then if there is an issue you can deal with them and the creditor to get it off your reports.

source

Experian 10

Why? I tried credit savvy and their website is just full of spam and deals that are completely unrelated. Plus my file had barely anything in it, which i assume is because they use experian data. At least getcreditscore.com.au use Equifax file which has all my credit info in it, so is clearly much more accurate.

source

Experian 11

In my experience, Experian is the credit bureaus most used by banks to review your credit, so I like knowing exactly what’s on that report. And as it turns out, Experian still shows an old bad/charged-off debt I have that Transunion and Equifax don’t list anymore for some reason, even though it hasn’t hit the 7.5 year mark to fall off. Sure, I wish Experian didn’t show it, either, but I’m really glad I signed up and can see it, as opposed to assuming that I’m in the clear. If I had relied solely on the FICO scores my banks & credit cards shows me for free (all Transunion info) or on Credit Karma, I’d think my credit score was much higher than what any new lender or creditor I apply to will likely find it to be. Honestly, I’m just glad I’m in the know with Experian.

Just as important (in my opinion) is that Experian shows me my FICO score based on their report. I am signed up for similar services with Transunion and Equifax , but Equifax doesn’t offer my score, and Transunion wants me to pay money to get my score. No way am I paying for that, so my Experian free service is definitely better than the other companies in that way.

source

Experian 12

Got a 11 pt increase because of my electricity bill. I am so surprised. Would this affect any other scores or just experian

source

Experian 13

It looks like the service will be opt-in since consumers grant permission for Experian Boost to connect to their accounts.

“After a consumer verifies the data and confirms they want it added to their Experian credit file, an updated FICO Score is delivered in real time. “

source

Experian 14

If you want Experian to have your bank account information, this seems like a good way to accomplish that.

source

Experian 15

Haven’t heard of it, but like you, I am extremely skeptical of anything Experian does. I would support a law requiring “opt in” credit scoring.

Possibly an unpopular opinion here, but I think that consumer credit (particularly the score) is a scam designed to trap unsuspecting people in a “sustainable” debt spiral. Unless you need to play their game in order to finance a major purchase, such as a house or car, why worry about your score? And if you do take out a loan, have a plan in place to pay it off as rapidly as possible.

source

Experian 16

If you already have a decent score then Experian Boost won’t help you. It’s designed for people who don’t fit into the traditional scoring model and have mostly avoided credit.

source

Experian 18

…just connect your bank account

Wow, as if experian didn’t know enough about you already – now they’ll know how much money you have, where you shop, how you spend your money, and maybe just maybe your score will go up a few points…

source

Experian 19

How may I improve my experian score? I pay my utilities on a timely basis

source

Experian 20

Ive had my tmobile on autopay on my checking account for about 2 years now and their program doesn’t seem to detect it even after I manually copy and pasted the transaction/date into the Experian website

source

Experian 21

Experian boost is NOT a scam

First I’d like to thank the poster who wrote about it being a scam as I’d never heard of the Experian boost service before.

After he made that topic, I signed up to try it out and after connecting my bank account, my FICO score went up 6 points immediately because it was able to upload my on time phone bill payments as eligible.

Awesome!

I’m considering doing this for my business checking account too.

Cool service and helpful to someone like me cuz my FICO is in the high 500s and I’m currently in the credit rebuilding process so every point counts!

source

Sneak peek

Home page

Footer

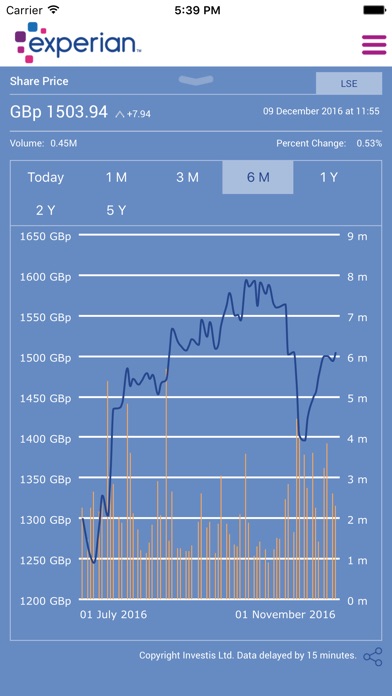

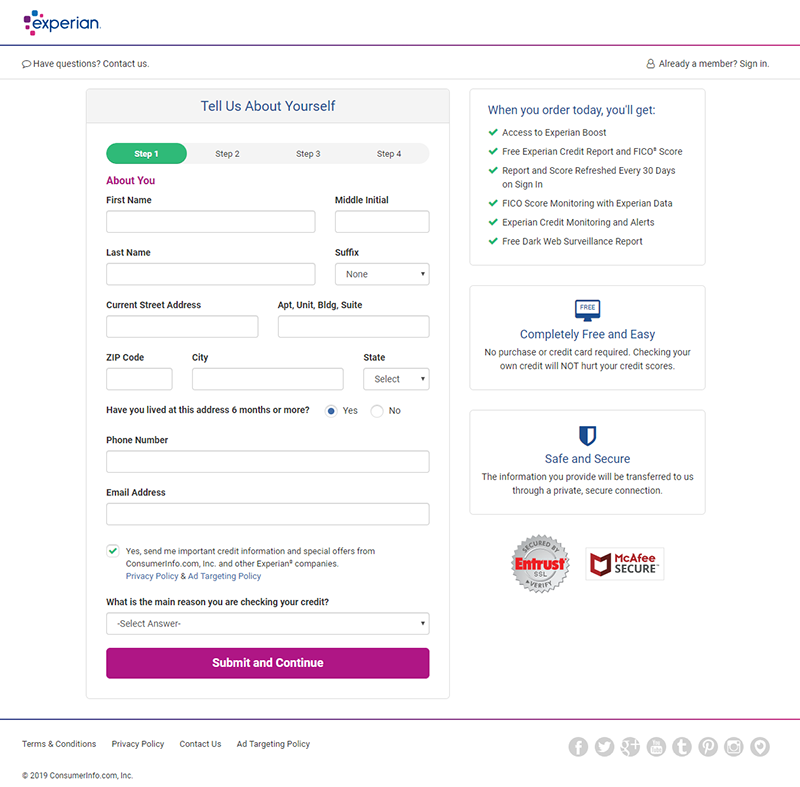

What’s inside

1

2

Changelog – pre-ecosystem era

v0.1.8 Hound @ apps.the.gt – b2b prospecting platform

v0.1.8.1 Business directory – content experiment to support b2b prospecting platform.

v0.1.7 White label agency solution, including white label lead generation & link building

v0.1.6 GRIN tech affiliate program is live.

v0.1.5.3 GRIN jobs experiment started

v0.1.5.2 Working on cool in-house lead gen project - Art Director is preparing 100 picks of Business Cards in various niches.

v0.1.5.1

GRIN games emerged

As a web agency we never could and never will be able to escape the urge of building things.

Among million other things we played with an idea of text-based games and the last piece that was missing

was the story itself. So via in-house outreach platform we found two

established writers that believed in the project and agreed to participate.

Shout out to Richard Abbott who wrote Fraud on Thetis and Eva Pohler who sent us a huge draft we are still reading through.

v0.1.4

GRIN launcher is born.

It is an outreach platform that we use to establish connections with editorial teams.

They say samples of published articles look good

but pricing looks even better

At some point we realised that list building, fetching contact details & outreach tech work just as well for b2b lead generation

v0.1.3

Once, we fell in love with ecommerce, because of short feedback cycles on marketing & development efforts.

Today we ship into production

inhouse SaaS project - AVOKADO - the web

app for learning languages with flash cards.

The year after we built it we realised how long is the road map ahead & what resources we'd need to promote it and decided to put it on hold.

One day as we ship GRIN tech v3.0 into production we'll distrupt the language learning market with Avokado.

We love Wordpress and recently shipped two plugins into open beta for commercial sale.

v0.1.2.2 King The Monk - wordpress plugin to virally grow your email list

v0.1.2.1 Plain Conversions - wordpress plugin to convert your visitors

v0.1.1. Expanded core offering to visual productions

v0.1

It's Autumn 2017 and GRIN tech agency's website is born.

We have it saved for the history.

Boring things: Privacy Policy